On the 13th and 14th March, Convene attended the Housing Finance Conference and Exhibition 2024 as a Knowledge Partner and Exhibitor with Convene ESG. We’d like to thank the National Housing Federation (NHF) for setting up such a thought-provoking conference, and for all those in attendance for their engagement.

The conference provided the space for finance professionals in the Housing sector to discuss some of the sector’s most pressing issues. This year is especially crucial for these discussions, and so the conference was an opportunity for Housing Associations to “take stock before the financial year end and a General Election”, which could lead to substantial consequences for the sector.

The conference allowed financial leadership to join peers, key stakeholders and experts in discussions surrounding the current economic landscape, as well as share concerns and introduce new insights so that Housing Associations can deliver the best possible service for their residents.

The first day of the conference started with a talk about the ‘big economic picture’ for Housing associations. This was followed by a talk on business planning in the sector, and whether these plans are a sustainable strategy or a short-term fix.

Then there were the morning breakout sessions, which looked at such topics as business planning and risk management, social impact data reporting, the upcoming trajectory of funding and Housing market updates.

The next breakout sessions looked at issues such as net zero and its economic benefits and redefining the role of the finance team. There was also a financial masterclass on market conditions for pension schemes and a roundtable discussion on how smaller Housing Associations can work together to improve finances.

After lunch, there was a talk on the government’s road to scaling up retrofit, with insights from Selvin Brown. Then there were more breakout sessions.

In the first of the breakout sessions there were talks on the insurer’s view of the evolution of risk in the sector, the future of AI in Housing finance, how to fund your retrofit project, and a Valuations update for the Housing Market. There were also discussions on what the new regulations mean for social housing providers, a financial masterclass on the changes to Financial Reporting Standards and SORP and a talk on business transformation.

The second of the sessions for the afternoon looked at topics such as the lessons learned from mergers, the role of digital in Housing finance, the role of profits and investment in pushing the developmental agenda, and building sustainable partnerships with funders. There was another financial masterclass in conversation with HMRC, a talk about elevating the workplace and discussions on V2 and what the ‘new normal’ actually means.

There was a final talk on navigating sector pressures whilst maintaining credit profiles. Then there was a keynote event to finish off the day, which discussed where tech could possibly take the sector.

The second day of the conference started talks about plans for public spending and tax on the sector with the Spring Budget, and how to finance a long-term plan for Social Housing. This was followed by talk by Clive Betts MP, which was an update on the inquiry into the finances and sustainability of the Social Housing sector.

There was another talk on the changes to the Affordable Homes Guarantee Scheme, before more breakout sessions began. The first breakout sessions discussed balancing competing priorities in an uncertain market, repairs and maintenance in digital data, and enabling the regeneration rollout.

There was also a discussion on the impact the new Sustainability Reporting Standard for Social Housing could have on securing borrowing. This talk features Convene’s own Arturo Dell, who spoke about green finance and the importance of creating a corporate culture where reporting is a priority.

He also spoke about Convene’s own reporting software Convene ESG, and how it can help Housing Associations with their reporting and the prioritisation of said reporting.

Convene ESG allows you to develop your ESG story by streamlining the administrative process of ESG reporting giving you time to focus on bigger goals and future visions.

Through data collection, peer comparison, and report generation, you are able to monitor your progress, achieve your targets and exhibit your success - creating a company which values ESG and makes a positive difference to the world whilst ensuring you meet regulatory requirements, industry standards and shareholder expectations.

The next breakout sessions looked at the future of rent policy for the sector, navigating volatility in treasury management, the role of leadership in finance business transformation and had a ‘meet the finance leaders’ talk.

After lunch there was a talk on VAT savings on procurement through the cost sharing exemption. This was then followed by a final set of breakout sessions.

These focused on optimising risk management, the long-term value of investing in cybersecurity, identifying viable models to generate new income, and stock quality and operational costs. There was also a discussion of the cost of living crisis, and whether we are ‘out of the woods yet’.

The day ended with a talk measuring the impact of Britain’s economic storm on residents, and looking at the future of Housing finance.

We’d like to again thank the National Housing Federation for giving Convene ESG the opportunity to exhibit at and be a knowledge partner for the Housing Finance Conference and Exhibition 2024. We’d also like to thank all attendees for your engaging discussions and participation in the conference’s exploration of the current state of finance in the Social Housing sector.

4 min read

Convene at the Housing Finance Conference and Exhibition 2024

By Lottie Wright on 15/03/24 14:34

Topics: ESG Housing

8 min read

Governance Issues affecting Housing in financial year 2025

By Lottie Wright on 01/03/24 14:51

Amongst unclear legislation and a cost of living crisis, Housing Associations need to be on top of their governance now more than ever. There are several governance issues that the sector needs to be prepared for, heading into the financial year 2025.

As said by the National Housing Federation, “Governance is the framework at the heart of a successful housing association. It sets standards of leadership and control and helps the board to define values by which the organisation will operate”.

First, it’s important to define governance, so we can label what exactly governance issues could be that could affect housing.

What is Governance, and what are Governance Issues?

Governance comprises all aspects of leadership and decision-making. It is the structures in place that allow a leader in any organised body to rule or control or dictate actions.

Corporate governance is the system a company chooses to put in place concerning rules, controls and policies to enforce a standard of behaviour.

Governance issues are therefore anything that could impact an organisation's ability to achieve good and effective governance, as well as the aspects of governance that companies and leadership teams need to be on top of this coming year.

Topics: Governance Housing

2 min read

Convene ESG and RITTERWALD Host Housing Associations and Lenders Lunch

By Gabriella Mangham on 26/02/24 13:57

On the 21st February Convene ESG and RITTERWALD hosted a lunch to help facilitate a network and discussions between housing associations and lenders about the realities of ESG Reporting and Financing. We wanted this to be an opportunity to air grievances and see the paths forward, and thankfully there were many productive conversations that have started because of this.

Topics: ESG SRS for Social Housing Housing

2 min read

Webinar: Convene ESG looks forward for 2024

By Gabriella Mangham on 20/02/24 16:26

Today Convene ESG hosted yet another successful webinar about what you can expect in the Housing ESG realm in 2024.

Topics: Sustainability ESG SRS for Social Housing Housing

6 min read

What to Prepare for 2024: Housing ESG

By Lottie Wright on 01/12/23 10:30

With the increasing focus on ESG in recent years, it's important to feel prepared for what this changing landscape can bring in the future.

For Housing Associations, the Prime Minister’s announcement of a policy overhaul on plans to help cut carbon emissions left the sector in limbo, and the recent appointment of a new housing minister, the 7th since the beginning of 2022, means that regaining a sense of stability is more critical than ever.

Staying ahead of trends, pushing ESG discussions forward and focusing on developing an effective reporting cycle will be crucial in helping Housing Associations feel secure in the face of future uncertainty.

Housing Associations need to be on top of their ESG reporting, and this includes choosing the right framework and solutions for your organisation.

Topics: Sustainability ESG Housing Frameworks

4 min read

Convene ESG Hears From Experts At Networking Event

By Gabriella Mangham on 18/10/23 10:03

Last week Convene ESG hosted another networking event for Housing ESG professionals. We had many interesting discussions during the cocktail hour about how best to approach ESG as an organisation. A common topic was how Housing Associations are working to embed a culture of ESG in their day-to-day activities.

Topics: Sustainability ESG SRS for Social Housing Housing

7 min read

Housing Insight: Why ESG Reports Matter

By Lottie Wright on 29/09/23 14:28

On the 20th September, Prime Minister Rishi Sunak announced an overhaul of policies intended to help the UK meet its target of cutting carbon emissions to net zero by 2050.

The prime minister said the UK could afford to adopt a more “pragmatic, proportionate and realistic” approach to achieving net zero.

This policy overhaul from the government leaves Housing Associations in limbo. It is unclear how the Sector should move forward with sustainability and decarbonisation plans.

This means it is more important than ever for Housing to be on top of their ESG reports, as it provides something to rely on in the face of uncertainty.

But what exactly did the Prime Minister’s announcement say, and what does this mean for Housing Associations moving forward?

What did Rishi Sunak’s announcement say?

The Prime Minister announced that targets to get households to switch away from fossil fuel boilers were being relaxed. Alongside this, he announced plans for tougher energy efficiency rules for landlords were being ditched. He also declared the ban on the sales of new petrol and diesel cars was being pushed back, from 2030 to 2035.

Three years ago the government set out its “preferred policy scenario” of all private landlords achieving Energy Performance Certificate rating C. For new tenancies this was from 2025, and for existing tenants it was by 2028.

Tenant bodies are outraged by the abandonment of this policy, amid concerns that the much-awaited Renters Reform Bill might face a similar fate.

Sunak claimed he would still “encourage” households to improve their energy efficiency, but that “under current plans, some property owners would have been forced to make expensive upgrades in just two years’ time”.

Additionally, the Prime Minister declared a 50% increase in financial support for grants under the government's boiler upgrade scheme. He said he does not want to impose costs on “hard-pressed families” at a time “when technology is often still expensive”.

While this might sound appealing, the 2035 deadline for putting in new boilers remains unchanged. The only new policy being the promise of an exemption for those who would find the switch to heat pumps the “hardest”.

The Prime Minister said this overhaul “doesn’t mean” he is “any less committed to decarbonising our homes”.

A significant portion of these changes will affect the Housing industry in one way or another. This Sector was already making progress towards the country's net zero goals by enhancing the energy efficiency of many homes, as well as starting to report on ESG through the SRS.

The changes leave many Housing Associations uncertain on how to proceed, as the details of what this means for the Sector has not been made clear by the government.

What is the response from the Housing Sector?

The potential impact of these changes for Housing Associations cannot be ignored. Many in the industry have already come out to share their thoughts on the upcoming changes and what they could mean for the Sector.

Kate Henderson, chief executive of the National Housing Federation, said it is “hugely disappointing” to see the government “row back from its commitments to net zero, particularly on improving the energy efficiency of our homes”.

She stated: “England’s homes are among the oldest and draughtiest in Europe. Making homes more energy efficient is a win-win, not only helping to save our planet, but also boosting our economy by creating jobs and, crucially, saving money.”

Rachelle Earwaker, senior economist at the Joseph Rowntree Foundation, said easing the regulations on energy-efficient homes is “ill advised and ill considered”.

She added: “If we don’t invest in energy-efficient housing and more sustainable and affordable energy solutions, the only certainty is frighteningly high energy bills and poor health outcomes.”

Dan Wilson Craw, deputy chief executive of Generation Rent, said scrapping higher standards for rental properties is a “colossal error” by the government, and that “energy efficiency” is an “essential part of a home’s quality”.

He stated that abandoning these policies is “both cruel and out of proportion to what the prime minister wants to achieve.”

What does this mean for Housing Associations?

Overall, this presents a huge problem for the Sector, which was already challenged with the enormous responsibility of reducing carbon emissions. Now, the industry is confronted with even more uncertainty regarding the government's objectives.

There are also significantly diminished prospects of securing the necessary funding to aid in decarbonisation.

Rishi Sunak and the government have promised a “pragmatic” transition in which the public continues to rely on gas boilers, ignore the issue of energy inefficient housing, delay the serious adoption of electric vehicles until 2035, and somehow, miraculously, achieve the significant reductions in carbon dioxide emissions necessary to achieve net zero.

The lack of clarity on how to move forward with sustainability plans, and how to give tenants the best quality service possible in spite of government policy, means a challenging road ahead.

All this highlights is that it is more important than ever for Housing Associations to communicate with their tenants, and assure them that their needs are your top priority.

The Sector needs to be able to ensure their environmental efforts are being demonstrated, and the public is made aware of them. Whether this be in energy efficiency and ESG goals or beyond, communication between Housing providers and tenants is crucial.

Additionally, with the possibility of more funding from the government appearing more and more unlikely, financing for Housing Associations is going to become more and more competitive.

With investors and consumers alike focusing on sustainability and ESG, reporting effectively and clearly, and showing your environmental progress is going to be critical in the face of these changes.

The earlier you start reporting, the more secure you can be in the face of instability within the Sector.

Why ESG Reports are more important than ever?

As well as achieving its target of net zero emissions by 2050, the UK government has to meet interim “budgets” along the way. Ministers have yet to flesh out important details of Sunak’s policy changes — such as exactly which households might be exempt from having to ditch fossil fuel boilers — so the impact on emissions is hard to calculate at this stage.

Moving forward, the Sector should continue to strive towards sustainability, and this means focusing on what you can do; ESG reporting, and the SRS.

Publishing an ESG report sets out your clear intentions for your organisation’s future, and its future projects. It includes your current investments and future investments into ESG. This will allow your potential investors to have a complete idea of how their money will be spent.

These announcements may make it seem like ESG should be less of a concern for the Housing Sector. The targets proposed by the government are unclear, and the elections next year may mean that it will all change yet again anyway! However, the Housing Sector has always pushed to be ahead of the curve, when government regulations are lacking, it is up to Housing Associations to provide the best service possible for their tenants.

Furthermore, investors, banks and loan providers will still be focused on providing green loans and ESG funding to Housing Associations. However, access to this money will be increasingly competitive without potential government assistance. The sooner you start reporting the more evidence you will have to provide investors of your year-by-year progress.

The SRS will also soon be launching their Version 2.0. which will address some of the common concerns that investors have. This will also help push the Sector forwards. During these uncertain times it is better to be ambitious than “realistic”, especially with the upcoming changes to the SRS allowing for a “comply or explain” approach.

The SRS helps level the playing field for all Housing Associations in terms of ESG by giving a criteria for them to focus on. Organising a standard allows the whole Sector to come together to determine what matters to them around the E, the S and the G in ESG.

The Housing Sector is one of the nations’ biggest polluters; if Net Zero is to ever be achieved then it is necessary to act sooner rather than later.

How Convene can help you with ESG Reporting

Here at Convene we have developed our own ESG reporting tool: Convene ESG.

Convene ESG is designed for Housing Associations with the assistance of Housing Associations. Our Early Adopters discussed with us what they needed, and with their requirements we developed a tool that would help Housing Associations generate the best ESG reports possible.

With Convene ESG you can compare benchmarks, organise your report, assign sections, automate reminders and input your ESG data and the solution will create a report ready to publish or edit as necessary. You can also input the data once and report against multiple different frameworks. This means you can provide lenders and your tenants with both a TCFD, RITTERWALD and SRS Report without repeating the work every time!

With the SRS Version 2.0 coming out this week, it’s as good a time as any to start ESG reporting.

This updated version has been produced using feedback from Adopters, Endorsers, and supporters of the Standard, and should help your association even further on your ESG journey.

You can find more about how Convene ESG can help your Housing Association here, or you can keep up with our dedicated events including networking opportunities and webinars here.

Topics: Sustainability ESG SRS for Social Housing Housing

3 min read

Webinar: Richard Hunt from CAF Bank

By Gabriella Mangham on 15/08/23 14:12

Today Convene ESG hosted another constructive webinar, this time we were joined by Richard Hunt from CAF Bank to talk about what borrowing green loans looks like.

Green Loans are a loan that the borrower has to exclusively use for sustainability projects. Increasingly in the Housing Sector, this means providing the lender with an SRS Report. During this webinar, Richard Hunt explained that there are 4 components that go together to form a Green Loan:

Use of Proceeds -demonstrating what the green loan will be used for.

Project Evaluation and Monitoring - ensuring funds are used appropriately.

Management of Proceeds - separate green loan bank account and providing invoices.

Reporting - ongoing proportionate reporting on the project.

Richard Hunt also detailed that we need a holistic approach. Sustainability is on everyone’s agenda, both customers, financing organisations and housing associations acknowledge its importance, but no one can make economic or governing decisions without data. The benefit of green loans may be the discounts, but the tying together for a common purpose is the key point. Energy efficiency and environmental sustainability is economically sound not only because for some rent and heating are costing the same amount but also because it will provide better risk management.

Sustainability in finance and green loans are the future, so investing now will save money in not only the short but also the long-term. If you would like to learn more, please rewatch the webinar here.

From all of us at Convene ESG, we want to thank Richard Hunt for his valuable insights and for sharing his knowledge. We believe that the Housing Sector working together can make great strides towards positive change, and Green Loans are a major part of this. Convene ESG want to be able to host more discussions like this in the future and already have some major events planned. To see more, visit our events page here.

Topics: ESG SRS for Social Housing Housing

2 min read

Convene ESG host Social Housing networking evening

By Josh Cole-Hossain on 24/07/23 17:26

On June 15th, the Convene ESG team hosted a networking evening at House of St Barnabas in London attended by governance and sustainability professionals in the social housing sector as well various guests invited by Convene ESG to give their insights into how ESG reporting is evolving in the housing sector.

Topics: ESG SRS for Social Housing Housing

5 min read

Convene sponsors the 2023 Housing Conference

By Lottie Wright on 30/06/23 09:42

Over the 27th, 28th and 29th June 2023, Convene sponsored the Unlock Net Zero stage at the Housing 2023 conference, Europe's largest housing festival and annual conference. We’d like to thank the Chartered Institute of Housing for setting up an incredibly engaging and collaborative event, as well as all our fellow attendees for making it such a memorable conference.

The conference provided us the chance to learn about, engage with and keep ahead of industry trends, as well as the opportunity to collaborate and converse with many people within the sector.

This year the conference looked to explore governance, risk, tenant voice, changing and resetting business plans, the importance of social care, health and housing integration, professionalism, reputation, the cost of living crisis amongst many other topics over the three days.

Topics: ESG SRS for Social Housing Housing

3 min read

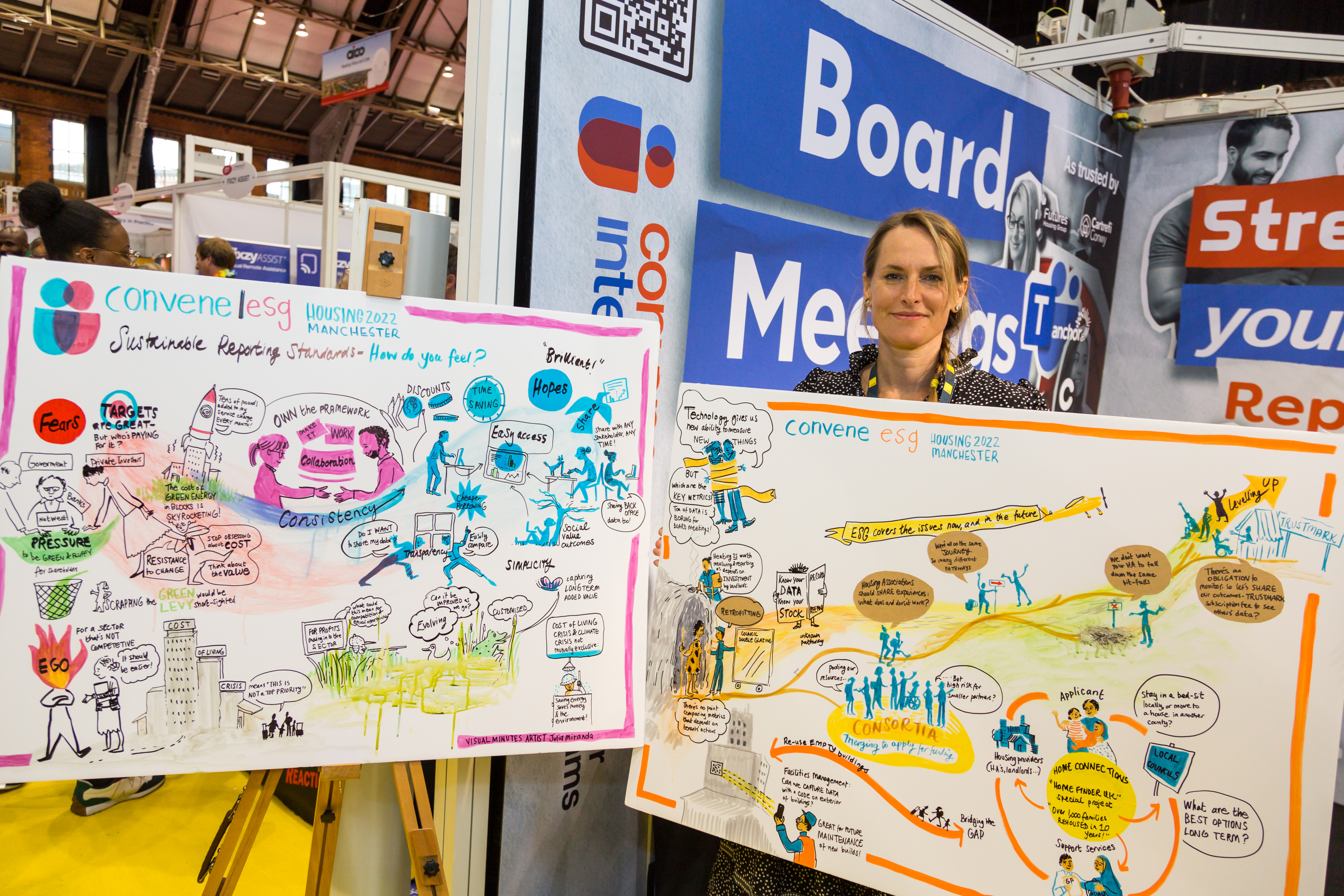

Julia Miranda talks about her process

By Gabriella Mangham on 27/06/23 14:02

At Housing 2023 we are joined by Julia Miranda, a graphic artist, who has helped us put together visual representations of trending issues in the sector relating to governance and ESG. We recently spoke to her about her process in creating these works.

Topics: Housing

3 min read

Convene Sponsors the NHF Housing Governance 2023

By Lottie Wright on 22/06/23 18:10

On the 22nd June 2023, Convene ESG exhibited at the Housing Governance Conference at the Royal College of Physicians, organised by the National Housing Federation. We want to thank all of the speakers and attendees for their engagement both online and in person, as well as the NHF for putting on a fantastic conference.

The conference is the sector’s only event specifically for Governance Teams and Company Secretaries to learn the latest legal, policy and regulatory updates and analyse their impacts.

The focus was on improving governance skills and performance, allowing delegates a space to reflect on how their organisation responds to crisis, and what skills and knowledge is needed to better prepare for the future.

The main goal of the conference was to establish what good governance looks like, at a time when the social housing sector is under enormous pressure. With governance teams finding themselves pulled in many different directions, Boards need to know they are meeting the requirements of the regulator, and of residents.

The topics that were discussed in the conference looked to emphasise the importance of flexibility and adaptation within the housing sector. There were several important talks throughout the day, including discussions on the use of data, resident voices, culture, Board succession, facilitating EDI conversations and more.

Topics: Governance Sustainability ESG Housing

5 min read

Why Housing Associations Should Care About Greenwashing

By Lottie Wright on 20/06/23 14:10

With ESG regulations on the horizon for many industries and sectors in the UK, and investors and consumers alike requiring organisations to have good ESG practices, it is important to understand how these efforts can be undermined.

The ‘E’ in ESG is particularly under fire, as an increase in greenwashing activity in recent years means that environmental efforts are being falsified. This makes it even harder to know exactly what sustainable improvements are being made, and who to hold accountable for this.

Housing Associations should care about greenwashing practices because environmental efforts being undermined can be damaging to the sector, its markets and the economy, as well as the planet.

However, before we dive into why you should take notice of greenwashing, let us first explore what greenwashing is and what it can look like.

What Is Greenwashing?

Greenwashing is the attempt to make a product, practice or even an entire organisation appear more environmentally friendly, ‘green’, and sustainable than it really is.

The lines between genuine reporting on ESG efforts and greenwashing can be a little blurred, due to the evolving nature of the ESG landscape and its regulations, so it’s crucial to understand what actually constitutes greenwashing.

Forms of greenwashing include:

Topics: Sustainability ESG Housing

4 min read

Webinar: ESG Reporting: Cutting through the complexity

By Gabriella Mangham on 21/03/23 16:41

Today Convene ESG sponsored Inside Housing’s Webinar on “ESG Reporting: Cutting through the complexity”, with guest speakers including Andy Smith(The Good Economy), Julie McDowell (Chair, Blackwood Housing), Russell Smith (ESG Lead, Orbit Group), Brendan Sarsfield (Chair, Sustainability for Housing) and our very own Arturo Dell (Convene ESG). We want to thank everyone for an insightful discussion into the status and future of ESG in Housing. In case you missed it, here are our key takeaways.

Topics: ESG SRS for Social Housing Housing

3 min read

Housing Finance 2023: What We Learnt

By Lottie Wright on 16/03/23 19:07

On the 15th and 16th of March, Convene attended the Housing Finance Conference and Exhibition 2023 in Liverpool. We want to thank the NHF, as well as all speakers and attendees for putting on and participating in an engaging and insightful conference. If you missed our talk, please join us at our Inside Housing Webinar next week.

The Housing Finance Conference focused on ‘building resilience through turbulent times’, and featured many interesting talks on topics surrounding the cost of living, sustainability and green finance, cybersecurity and the future of the housing sector.